Former Casino Nanaimo employees have launched a class action lawsuit for wrongful dismissal against Great Canadian Gaming Corporation (GCGC), which appears to have taken government subsidies despite remaining closed during the course of the pandemic.

The terminated employees are calling the actions of the company “reprehensible.”

In October 2020, 27 employees filed individual lawsuits against the company, which operates casinos across Canada, including the River Rock Casino and Resort in Richmond, its flagship B.C. facility. In April, three more employees – Catherine Fanning, Kimberly Bussiere and Samantha Heffel – launched class proceedings on behalf of all employees.

Casino Nanaimo was shut down March 16, 2020, due to COVID-19, and the company has since permanently abandoned the operation. Unlike other GCGC facilities, Casino Nanaimo was non-unionized.

The company (GCGC and subsidiary Great Canadian Casinos Inc.) is alleged to have caused undue hardship over the past year. According to the claim, employees were not permitted to draw down on banked vacation pay and several benefits were terminated. Some employees claim the company never communicated to them about the status of their jobs during the entire time and never got consent to extensions of the temporary lay-off period.

One allegation includes how in July 2020, some employees, who usually received tips, were provided envelopes of cash from the trunk of a manager’s vehicle.

Then in September, the employees allege they were forced into a buyout that was equivalent to the Employment Standards Act (ESA) of one week of salary per year of service up to eight weeks pay. The company is said to have required the buyouts to be taken as severance, which would have disentitled them from employment insurance.

The claims allege the company did not recognize terminations under the ESA on August 30, 2020, when the provincial government mandated temporary layoffs to become permanent.

“The way Great Canadian has attempted to force destitute workers to take a buyout that leaves them stranded in a month’s time is reprehensible,” states the claim, which seeks aggravated and punitive damages for wrongful or constructive dismissal.

Other claims, filed last October, such as that of Marlene Holland, allege further transgressions by the company, such as unsafe work conditions.

Holland claims the company’s “representations and negotiation strategies lengthened the time it will take [her] to recover from the deleterious economic effects of her job.”

Holland committed 35 years of her life to the company, according to her claim, and was entitled to more compensation than she got.

The company responded to Holland by refuting much of her claims in a response to the court. It stands by its decisions and claims it “acted fairly and in good faith towards the Plaintiff.”

Great Canadian has not responded to the class action claim, which notes the Canada Revenue Agency lists Casino Nanaimo in receipt of the Canadian Emergency Wage Subsidy (CEWS).

Glacier Media asked GCGC to explain how much CEWS it had taken for Casino Nanaimo and what the money was used for, but has not received a response.

The ethical conduct of the company has come under public scrutiny, first at the Commission of Inquiry into Money Laundering and then when its CEO Rod Baker was ticketed and charged January 21 under Yukon’s Civil Emergency Measures Act for failing to self-isolate for 14 days upon arrival to Yukon and failing to behave in a manner consistent with his declaration.

Baker allegedly flew to Yukon and drove to a remote community that had been receiving coronavirus vaccines because it had a high rate of vulnerable indigenous people.

Baker stepped down from the company after he was charged. He is due in court June 15. It is understood prosecutors and his defense team are in negotiations. The allegations against him sparked public outrage. He faces a maximum six months in jail if found guilty.

At the inquiry, River Rock came under scrutiny for failing to adequately report suspicious transactions. The company claimed, however, it was always working to improve its anti-money laundering regime. Testimony showed the casino, in concert with B.C. Lottery Corporation, routinely accepted six-figures worth of $20 bills.

The casino was intended to serve a domestic audience but ended up marketing to an international clientele in China.

Adding to matters in the class action is the delisting of the company after shareholders sold it to private firm Apollo Asset Management Fund in December 2020. The company states it expects to close the deal this financial quarter.

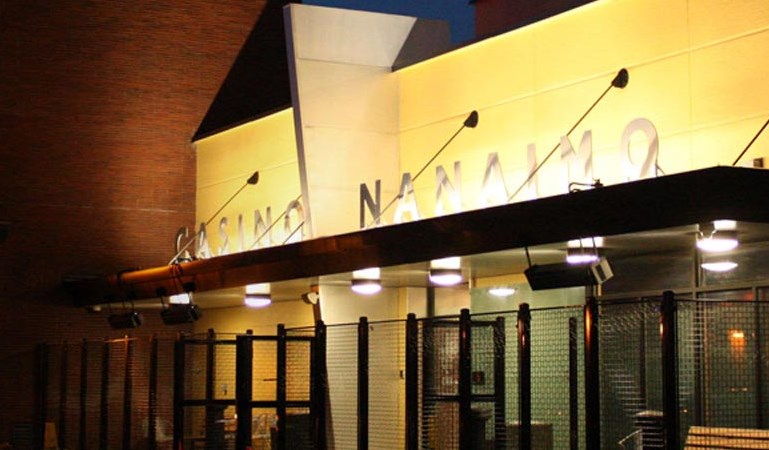

Casino Nanaimo was a 42,000 square foot casino located in downtown Nanaimo, according to company records. The casino featured approximately 430 slot machines, six table games, three poker tables, a racebook and a restaurant.