After hearing details on how to avoid a myriad of offline and online scams and crimes, one attendee summed up the advice.

“It’s scary out there. When in doubt, don’t push anything,” said the senior following a Delta police presentation on fraud last week at KinVillage in Tsawwassen.

Seniors are targeted for scams because they’re vulnerable, lonely or isolated, too trusting and may have cash saved up from a lifetime of hard work.

“You were raised to trust people and believe that people are out to do good things. Unfortunately, that is your biggest downfall, that is you are too trusting,” said Leisa Schaefer, media relations officer.

But younger people are also targeted and also trust too much such as when agencies hand over information without checking to see if it’s actually police making the request, said Const. Dustin Classen, with Delta police’s cyber crime unit.

Police gave safety tips on a raft of scams, some old and some new.

North 40 dog park a haven for thieves

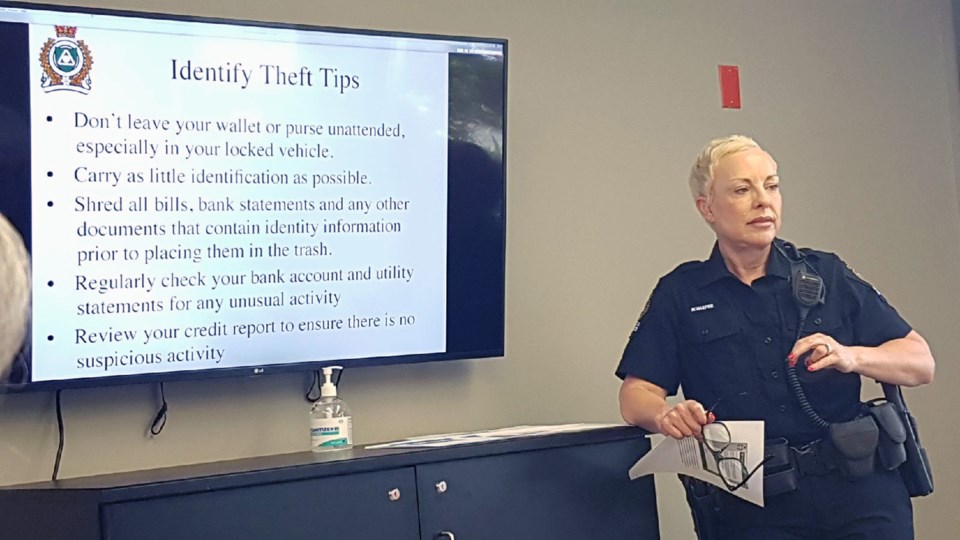

Anti-fraud advice that dates from before the online world, is still valid.

For example, any paper statements or bills with personal info on them should be shredded or destroyed so information doesn’t find its way into a recycling box or dumpster. Also, from the pre-internet age, don’t leave your purse or wallet in your car, carry as little identification as possible and check your bank statements regularly.

“The North 40 dog park is infamous for people doing that, (vehicle break-ins)” said Classen.

Only about five per cent of scams are reported to police with people often too embarrassed to admit they’ve been cheated.

But even computer experts can fall victim to crime, he said.

Overall, about a million people in Canada each year, fall victim to fraud, with credit card fraud costing $548 million and debit card fraud costing $16 million.

One recent trend that is more serious, involves the increase in the number of bitcoin machines, similar to ATMs, that are popping up around town, willing to gobble cash anonymously.

“By and large, it’s the victims who are using these machines,” said Classen.

Many scams involve aggression, fear and threats, such as arrest or deportation, made over the phone saying only the caller can help them and demanding they talk to no one.

Classen even saw a scam in action last year while on patrol and noticed a man and woman looking confused at a bitcoin ATM.

The woman was trying to buy a puppy online and was being cheated for cash at each stage of the process, despite being warned it was a scam.

The woman even texted the scammers to send her the puppies because she didn’t want to talk to the detectives again.

Once people give money the first time, it’s easier for them to be duped a second time. “Once you start giving, I don’t know what it is, you keep giving,” Classen said.

How to avoid telephone fraud

The audience watched a brief video depicting the grandparent scam, which involves the panicked voice of a younger person who’s in a crisis calling grandma or granddad and saying he or she needs cash right away.

After the grandchildren reel in the senior, another voice comes on the line with detailed instructions on to deposit the money.

Staying safe requires being alert to a myriad of scenarios that could separate someone from their money.

Telephone fraud has been around for awhile.

If you see a “+1” in front of the 778 prefix, it’s likely a fraud call, Classen added.

And once you answer, you’re likely to get more calls later.

“If you don’t recognize the number, you don’t need to pick up,” Schaefer said.

“If somebody really needs to get a hold of you, they’ll leave a message.”

Avoid clicking on unknown web links

When it comes to the world wide web there’s an almost infinite number of ways that people can be defrauded, have their identity stolen or allow predators into confidential files.

Clicking on a phoney link, either on a web page or in a text or email on a mobile phone could install malware into the device. That could then turn on the cellphone's camera, and allow access to emails and passwords.

Fake email or text notices supposedly from banks or the Canada Revenue Agency are common. Clicking on any link, just out of curiosity, can lead to trouble.

“So just clicking on that link can cause a whole world of hurt,” said Schaefer.

Pop-up notices supposedly from Microsoft about web security or updates are also phoney

As well, people should be careful about the type of websites they sign up for. If those sites are no longer used, cancel them, Classen added.

Spoof websites that purport to be something they’re not should also be avoided as well as strange texts and links that come into your phone.

“We don’t click on the link. There’s no confusion in your mind,” said Classen. “Don’t click, delete.”

A growing issue is that of sextortion which involves an impersonator asking for revealing photos, only to seek more explicit photos, threatening to shame the victim publicly if they’re not sent.

One case of investment fraud in Delta had a resident losing both her home here and in China. She sold both to raise funds for an investment scam. “Right now, she’s not sure where she’s going to be living next month,” Classen said.

Never give out your personal information

Never give out your name, date of birth, social insurance number or address, he added.

Identification fraud is prevalent, said Schaefer.

Once someone has your identity, they can use it to lease a high-end vehicle which is later shipped overseas.

Data breaches on companies that store your personal information, such as what happened with Equifax a few years ago, “happens a lot,” said Classen.

Keeping computers, tablets and cellphones up to date with the latest operating systems and anti-viral software is critical.

If you do click on a suspect link, don’t use the computer and take it to an expert for diagnosis.

If seniors think they’ve been scammed, cheated or defrauded call the cops.

“Forget about being embarrassed. Do call us,” said Schaefer.